PM SVANidhi Yojana 2024: The Government of India is running various schemes to increase the level of employment, one of those schemes is PM Svanidhi Yojana, under which loans are provided by the government to small traders setting up readymade garments in the country.

Small businessmen can expand their business by getting a loan under the Pradhan Mantri Swanidhi Yojana. If you are thinking of taking a loan under the PM Swanidhi Yojana, then let us tell you that under this scheme you can take a maximum loan of ₹ 50000.

The PM SVANidhi Yojana (Prime Minister Street Vendor’s AtmaNirbhar Nidhi) is a scheme launched by the Government of India in June 2020 to provide affordable loans to street vendors. The goal is to help them recover from the economic impact of COVID-19 and become self-reliant. Here’s an overview of the scheme:

Key Features of PM SVANidhi Yojana:

- Loan Amount:

- Provides collateral-free working capital loans of up to ₹10,000 for street vendors.

- The loan can be repaid in monthly installments over a period of one year.

- Interest Subsidy:

- Vendors can receive an interest subsidy of 7% per annum. The subsidy is credited directly to the borrower’s bank account every quarter.

- Digital Transactions Incentive:

- Vendors are encouraged to repay their loans through digital platforms. Cashback incentives ranging from ₹50 to ₹100 per month are provided for using digital transactions.

- No Collateral Required:

- The loan is completely unsecured, meaning street vendors do not need to provide any security or collateral to get the loan.

- Loan Repayment and Next Loan:

- If vendors repay the initial loan on time, they are eligible for a higher loan (up to ₹20,000) in the next cycle.

- Eligibility:

- Street vendors who have been in business on or before March 24, 2020 are eligible.

- Vendors from both urban and rural areas can apply.

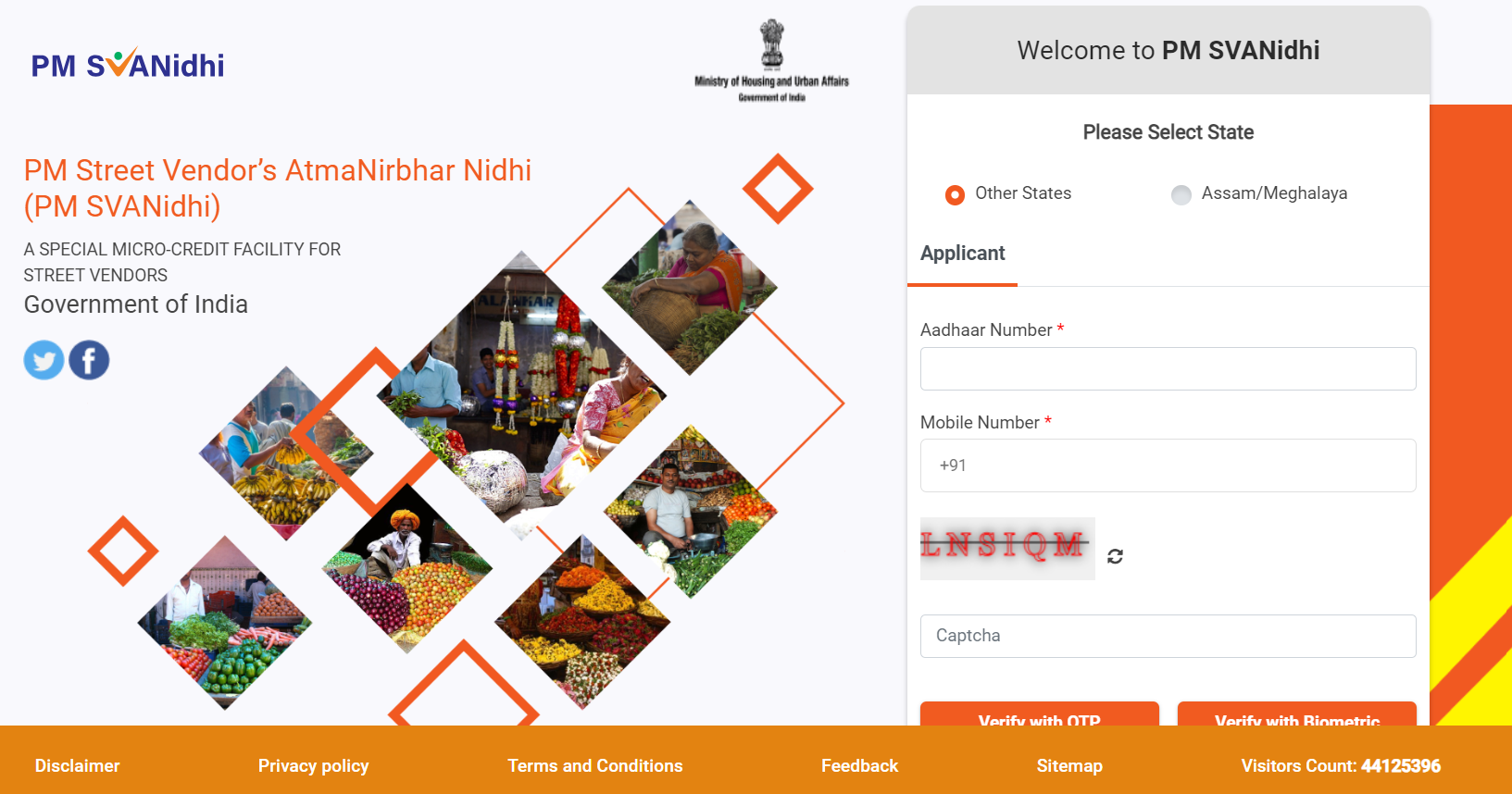

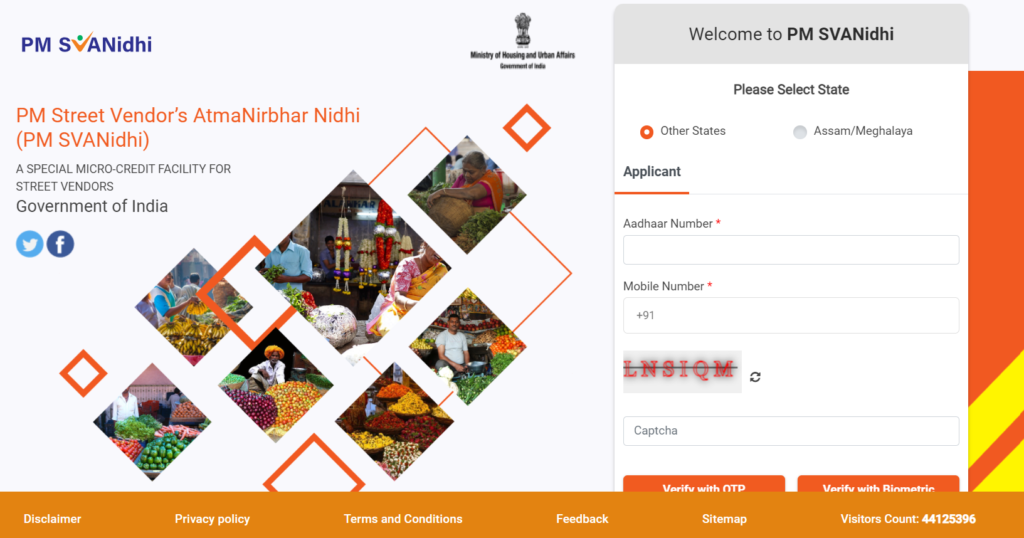

- Application Process:

- Vendors can apply for the loan through Common Service Centres (CSCs), banks, or directly via the PM SVANidhi portal.

- A simple KYC process is followed, and vendors need to provide identification like Aadhaar and vendor identification cards.

Benefits:

- Economic Support: The scheme aims to revive the livelihood of street vendors, giving them the necessary funds to sustain or restart their businesses.

- Financial Inclusion: By encouraging digital transactions, the scheme helps vendors integrate into the formal banking system.

How to Apply:

- Visit the official PM SVANidhi portal: https://pmsvanidhi.mohua.gov.in/

- Application: Fill out the online form with details like Aadhaar number, bank account, and vendor identification.

- Loan Approval: After verification, the loan is disbursed by banks or microfinance institutions.

Would you like more detailed guidance on applying for this scheme or eligibility checks?

How can you take a loan under the PM Swanidhi scheme? How much interest will you have to pay on the loan received under the PM Swanidhi scheme? We are going to tell you complete information about the eligibility, application process etc. of this scheme in today’s article, so read the post till the end.

PM SVANidhi Yojana 2024 Overview

| Name of the article | PM SVANidhi Yojana 2024 |

| Name of the scheme | PM SVANidhi Yojana |

| who started it | By the Indian Government |

| Beneficiary | roadside merchants |

| Loan amount | ₹10000 to ₹50000 |

| application system | Offline |

PM SVANidhi Yojana 2024

PM Swanidhi Yojana has been started by the Government of India for the common traders who set up roadside stalls, in which the government provides a loan of up to ₹ 50000 at a very low interest rate. Let us tell you that only 7% interest has to be paid on the loan received under the Swanidhi scheme.

Also, there is no need for any kind of grantor to get a loan under this scheme. If the applicant takes more time to repay the interest, then he will not have to pay additional interest in it.

Under the PM Swanidhi Yojana, loans are provided by the government to small roadside traders. Under this scheme, initially a loan of ₹10000 is received, then ₹20000, ₹30000 to ₹50000 is received.

PM SVANidhi Yojana Benefits

- Under PM Swanidhi Yojana, you can take a loan of up to ₹50000 to expand your business.

- There is no need for any type of grantor to get this loan.

- Under the PM Swanidhi Yojana, a loan of ₹ 10,000 is received in the first installment.

- In this, maximum loan amount of ₹50000 is available.

- Under the PM Swanidhi Yojana, the government provides loan facilities to street vendors and readymade traders.

PM SVANidhi Yojana Eligibility

- If you want to get a loan under PM Swanidhi Yojana, then your age should be more than 21 years.

- Under the PM Swanidhi Yojana, small traders or state vendors get loans.

- If any member of the applicant’s family is employed in a government job or any member of the family pays tax, then the benefit of PM Swanidhi Yojana will not be available.

PM SVANidhi Scheme Documents

Under the PM Swanidhi Yojana, if you want to get a loan of ₹ 10000 to ₹ 50000, then for this you will need some documents in the application such as –

- Aadhar card

- PAN card

- Bank passbook

- 6 months bank statement

- Mobile Number

- Passport size photo

- Basic address proof

- Income Certificate

- Caste Certificate

PM SVANidhi Yojana 2024 Registration

If you want to get a loan under the PM Swanidhi scheme, then its application process is very easy. You can get a loan under the application process given below –

- To apply for PM Swanidhi Yojana, first of all you have to go to the nearest bank.

- After going there, you have to talk to the bank employees about PM Swanidhi Yojana and get the application form.

- After applying, the form has to be filled and the photo has to be affixed with the form.

- After this you also have to put your signature on the form.

- Also, the slip of required documents required has to be collected along with the form and submitted to the bank.

- After this the bank officials will verify your application.

- If the investigation is found correct, the loan amount will also be made available to you.

PM SVANidhi Yojana Helpline Number

No helpline number has been issued under the PM Swanidhi Yojana, but you can get special information about this scheme by visiting the nearest bank.

| OFFICIAL WEBSITE | CLICK HERE |

| HOME PAGE | CLICK HERE |