Post Office RD Scheme 2024: Friends, many types of savings schemes are run by the post office, in which people are getting good returns by investing. If you are also interested in investing, then the RD scheme of the post office can be a good option for you, if you invest in this scheme, you will get a very good return. You will not have any problem in this, you get guaranteed returns.

If you are employed and want to get huge returns by saving small amounts from your salary, then you can invest in the RD scheme of the post office . By investing in this scheme, you can get very good returns in the future. Many savings schemes are also being operated by the government through the post office. Next we will give you complete information about the Post Office RD Scheme .

This scheme of post office 2024

Post Office RD Scheme is a scheme that gives tremendous returns. Lakhs of people are taking advantage of this scheme by investing under it. If you do a job and want to save small amounts from your monthly salary, then you can secure your future by investing in Post Office Recurring Deposit Scheme . By investing in this scheme, you will get strong returns in a very short time.

In this scheme, you have to deposit a fixed amount every month on which you get a very good return after a certain time period. Post office scheme is the first choice of many people for safe investment, so you do not need to worry because in this scheme you will get guaranteed returns. The interest rate of this saving scheme is decided by the government every 3 months.

This post office scheme is giving you a strong interest rate

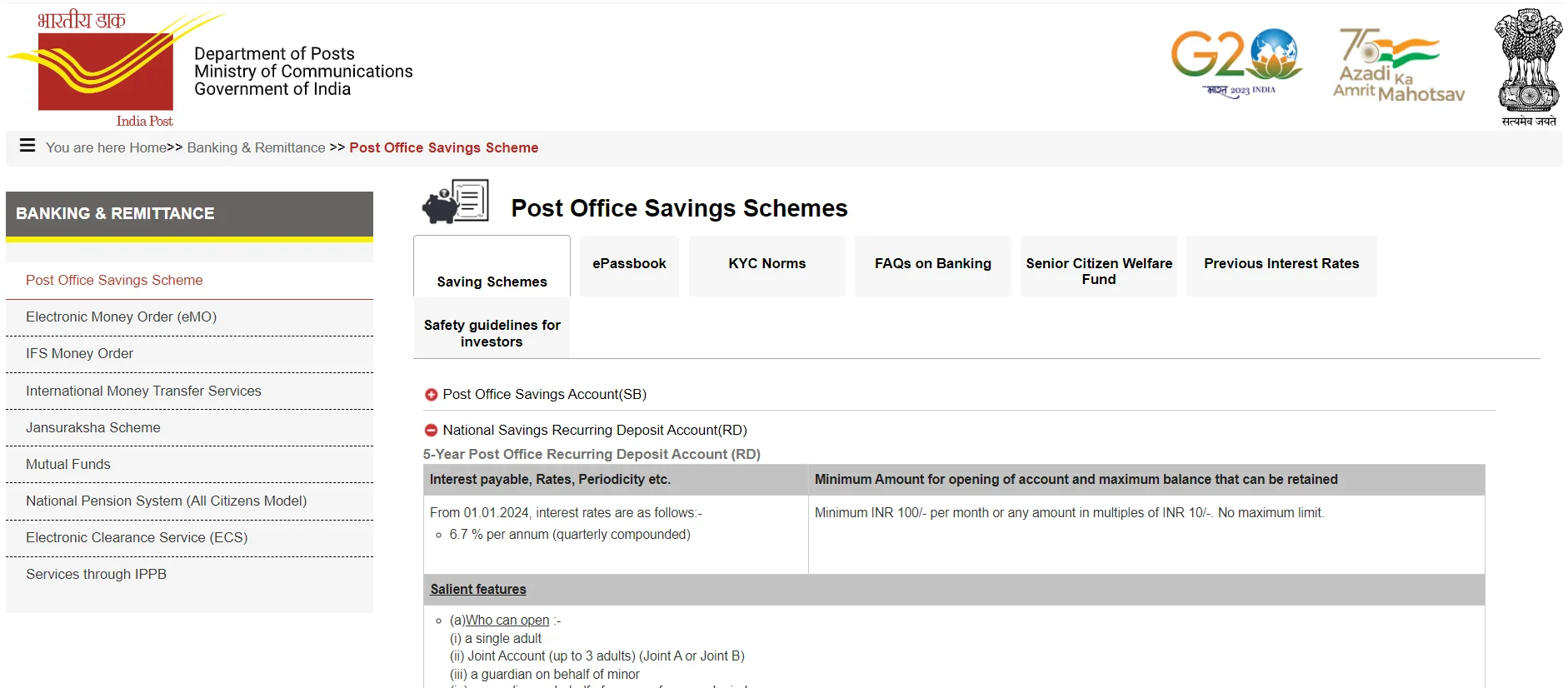

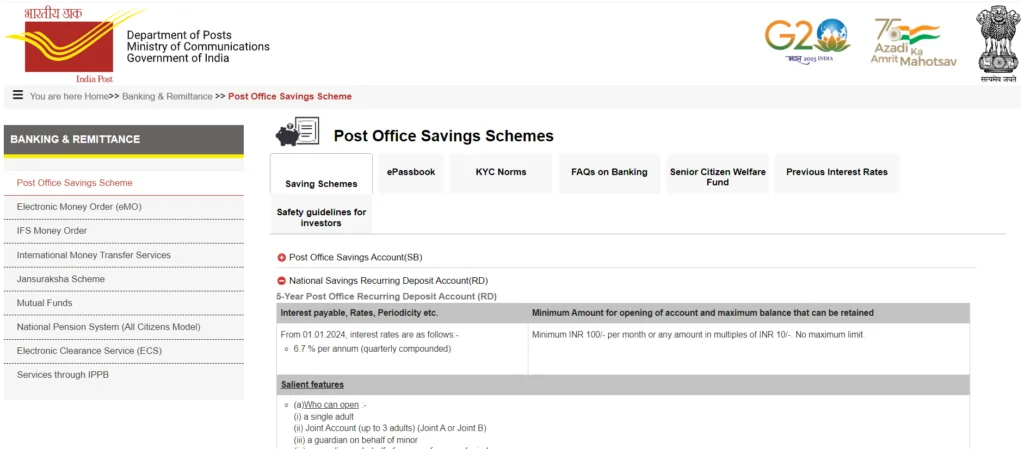

If you are also interested in investing in Post Office RD Scheme , then let us tell you that the interest rate of Post Office RD Scheme has been increased by the Central Government. If you invest in this scheme, then now you will get an interest rate of 6.7%.

How much return will you get by investing ₹ 5000 in Post Office RD scheme

- If you invest ₹ 5000 every month in the RD scheme of the Post Office, then after investing for 5 years, you will have accumulated an amount of up to Rs 3 lakh.

- If you get money at an interest rate of 6.7% on a deposit of Rs 3 lakh, then your interest will be Rs 56,830.

- In this way, after completion of maturity time, you will get Rs 3,56,830.

How much return will you get if you invest ₹3000 in Post Office ID Scheme

If you invest ₹3000 every month in the Post Office RD scheme, then you will have 1,80,000 rupees in 5 years. If you get interest at the rate of 6.7% in this, then your interest amount will be 34,097 rupees. Thus, after 5 years i.e. after completion of maturity period, you will get 2,14,097 rupees.

Post Office RD Interest Rates

Besides extending mail services, post offices offer several financial services to their customers in the form of savings schemes and life insurance. Typically, a post office RD is among the most popular savings alternatives to traditional fixed deposits and other long-term schemes offered by post offices.

Post office Recurring Deposits have become the most preferred instruments when compared to banks. One of the reasons behind its popularity is the attractive interest rate one can earn on them and a great profit upon maturity. The post office RD interest rates are revised in a proper interval and and the current interest rate is 6.50% p.a. The interest is compounded quarterly which enables the money deposited to multiply till the maturity time.

Post Office RD Interest Rates 2024

| Tenure | RD Rates for General Citizens | RD Rates for Senior Citizens |

| 5 years | 6.50% | 6.50% |

| Post Office RD Scheme | CLICK HERE |

| Homepage | CLICK HERE |

Features of Post Office RD Scheme

- The interest rate provided by the Post Office on RD is 5.80% p.a. compounded quarterly.

- The tenure of a post office RD is 5 years

- The minimum deposit to be made in an RD account is Rs. 10 per month

- There is a rebate provided on advanced deposits of at least 6 months

- There is no cap on the upper limit, provided it should be in multiples of 5

- The Post Office RD account can be transferred from one post office to another

- A joint account can be opened by two persons

- The penalty for missing a deposit is charged as 5 paise for every Rs. 5

How to Calculate Post Office RD Returns?

The sum of interest offered on a Post Office Recurring Deposit follows the compounding principle. It uses the compounding interest formula mentioned below to calculate the sum of interest.

A= P x (1+R/N) ^ (Nt)

Here,

A= Maturity Amount

P= Recurring deposit

N= Number of times the interest is compounded

R= Rate of interest

t= Tenure

For example,

Mr. G invests Rs. 6,000 into his PORD at the rate of 7.2% p.a. for 60 months. The sum accrued at maturity would stand at –

A= P x (1+R/N) ^ (Nt)

= Rs. 4,33,883

Components of the RD Interest Rates in Post Office 2024

Tenure

Unlike the recurring deposit at banks, post office RD tenure is fixed, i.e. 5 years. Most people open an RD account to use it as immediate support in case of any inevitable emergency in the coming years making it an instrument being used as a medium-term investment option. Presently, an RD account in a Post office has a minimum tenure of 5 years, which means one needs to ensure that his/her account is active during this period.

If one wants to continue with the RD account even after 5 years, there is a provision for the same under which the RD can be extended to 5 more years making the maximum tenure is 10 years.

Minimum and Maximum Deposit

A recurring deposit is one of the most preferred investment tools to earn good returns on your monthly investment. The minimum deposit is kept very low to ensure that it’s under the budget of people who are often skeptical about the deposit amount and rate of interest. As per the post office RD rules, the minimum deposit is Rs. 10 per month and the maximum deposit has got no limit. One can increase the deposit amount in multiples of Rs. 5, ensuring that they invest whatever amount is feasible.

Dates of Deposit

A post office RD requires a total of 60 deposits during the tenure, i.e. one deposit every month for 5 years. The first deposit is made when the user opens the account following the subsequent monthly deposits to be made on or before a particular date, depending on the date the account was opened.

Coming down to the exact dates, individuals who open their account between the 1st and 5th of a month must make the monthly deposits every month for the next 5 years. Accounts opened after the 15th of a particular month are needed to make the payments between the 16th and the last day of subsequent months. For making deposits, one can use the model of demand draft, pay order or a cheque.

Penalties on Delayed RD Deposits

A post office RD allows the account holder with a maximum of 4 such defaults; in case he/she fails to make the 5th monthly payment in his/her account, the account becomes inactive (discontinued account). Such discontinued accounts can be revived within 2 months of the 5th default.

According to the post office RD rule, a default penalty of 5 paise is charged for every 5 rupees which are going to be deposited in the account. The bank charges this fine to be paid in addition to the previously missed deposit amount in order to activate the account.

Post Office RD Rebate

To lure people into depositing money in advance, a rebate on advance deposits is provided by the post office RD. The rebates might not sum up to a big amount but can contribute to saving a considerable amount for other purposes.

Premature Withdrawal of Post Office RD

Individuals can access their Post office recurring deposit and fund their urgent requirements. But they can withdraw from such an account only after a year of opening it up to 50% of the available funds. A simple rate of interest would be applied on the withdrawn funds and it needs to be repaid in lump-sum along with the interest applicable.

Loan Against RD

You can apply for a loan against your National Savings Recurring Deposit by completing Form-5. To qualify for the loan, you must keep the account open for a year and deposit 12 installments. You can borrow up to 50% of the sum credit on your RD account. The account holder has the option of repaying the loan in a lump sum or in equal payments. The account holder must repay the entire amount before the RD matures.

The applicable simple interest rate on the loan will be 2% plus the applicable RD interest rates on the RD account. Interest will be charged from the date of withdrawal until the date of final repayment, in proportion to the amount of payback. If you fail to repay the loan, the PO will deduct the loan plus interest from the RD account’s maturity value. If the account is kept through maturity, the repayment can be made over a longer period of time.

If you do not repay the loan in full or in part, the amount owed will be recovered from you, your legal successor, or the nominee when the account is closed. If the interest payable on the loan exceeds the interest on the RD, the account holder must pay the difference.

Eligibility of the Post Office RD Interest Rate

Individuals who want to open an RD account in Post Office must meet these criteria –

- Indian Nationals who are over the age of 18 years.

- Minors who are over the age of 10 years.

- Parents or guardians who wish to open and operate the account of a minor on their behalf.

- Indian nationals above the age of 18 years would be deemed eligible to operate an RD account in Post Office either singly or jointly.

Documents Required to Open an RD Account

- A post office account-opening form

- Two photographs (passport size)

- Address and identity proof such as Aadhaar, passport, PAN card, or declaration in Form 60 or 61 as per the Income Tax Act, 1961, driving license, voter’s identity card, or ration card.

- identity proof for verification purposes at the time of opening the account

- Select a nominee and a signature of a witness to complete the formalities

How does Taxation Apply to a Post Office RD Account?

An RD account in the post office falls under the tax exemptions umbrella as per Section 80C. Individuals can claim up to Rs. 1.5 Lakh as per annum tax exemption under this section.

However, the interest generated through the post office RD scheme is liable for taxation. Individuals need to pay a tax amount as per their income tax slab. Additionally, an interest that exceeds Rs. 10,000 would be liable for a TDS deduction. Individuals who have an active PAN would pay TDS at the rate of 10%, while those without one would pay the same but at the rate of 20%.

The Rebate Offered for Post Office RD Interest Rate 2024

Rebate is the discount offered to the Post Office RD Scheme holder by the post office to encourage them to deposit money into their account in due advance. In the case of the RD scheme in the post office, individuals would be able to avail rebates on their deposits that were invested at least 6 months in advance. Moreover, such rebates are made available on a deposit equivalent to at least 6 installments.

However, in case of delay in deposits, individuals would be liable to pay the penalties. They are allowed a maximum of 4 defaults after which their account will be discontinued. They would accrue a default penalty of 5 paise on every Rs. 5; the sum penalty accrued along with the missed deposits would have to be deposited into their RD account. Individuals can revive their ‘discontinued account’ within 60 days post their 5th default.