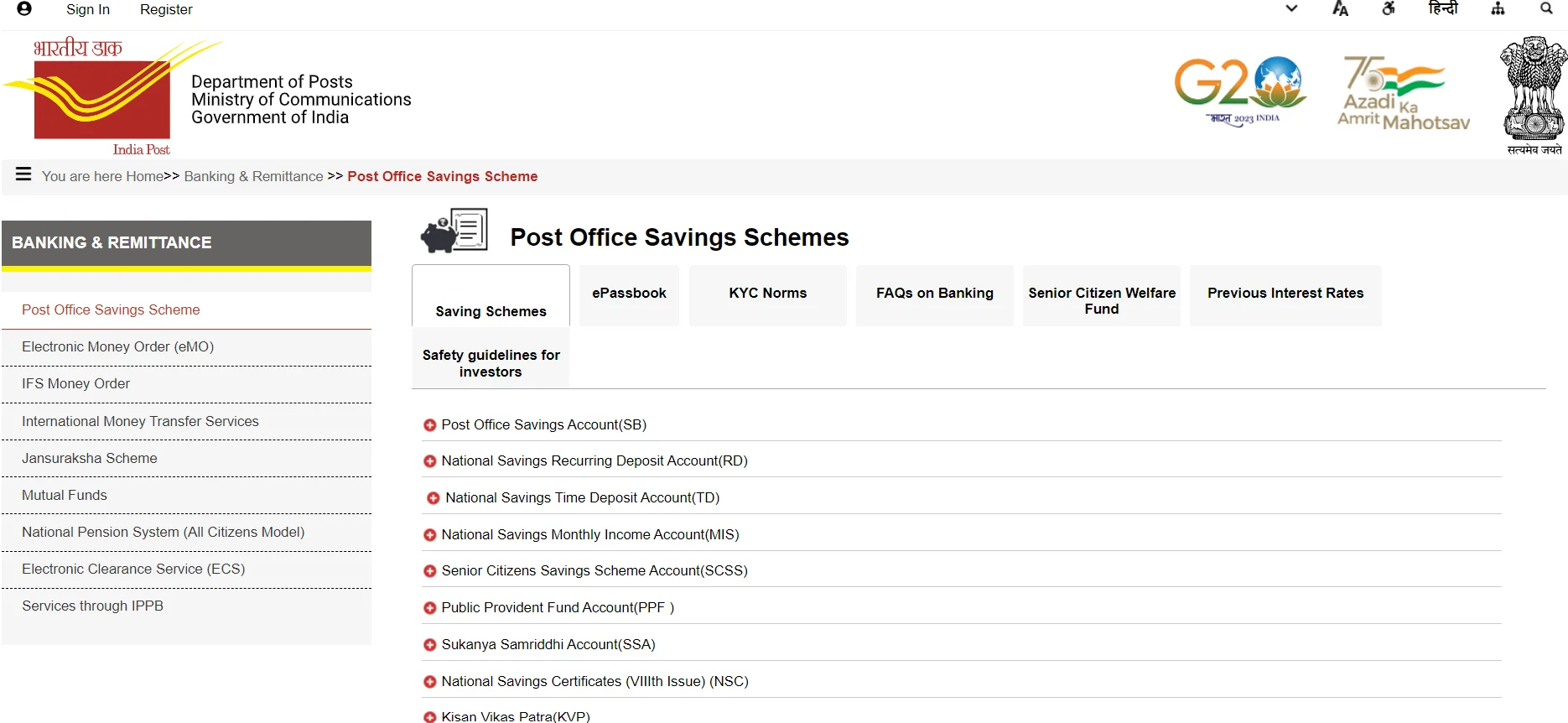

Post Office Scheme: The central government is running many schemes for the financial help of the people of the country. Schemes are being run for women, youth to senior citizens. Most of the government schemes are being operated from the post office. One such scheme is being run through the post office. With this scheme, you will get Rs 2.32 lakh in just two years. It comes under the small savings scheme.

The most important thing is that there is almost no risk in all the schemes running under the post office. Apart from this, one also gets the benefit of tax benefits, monthly income and guaranteed returns. Some schemes of the post office are for retirement, which guarantee financial help on retirement. In this news, we tell you about the Mahila Samman Saving Certificate Scheme of the Post Office. Let us know the complete information about this scheme…

What is the scheme? The

Mahila Samman Saving Certificate Scheme was started by the government to provide financial assistance to women. Under this scheme, you can deposit from one thousand rupees to two lakh rupees. The money deposited should be in multiples of 100 only. Many accounts can be opened under this scheme, but the maximum deposit amount should not exceed Rs 2 lakh. There should be a gap of 3 months between the date of opening the second account under this scheme.

This is

the interest rate on this scheme at the rate of 7.5 percent per annum, but the interest is credited on a three-month basis. The maturity period of this scheme is only 2 years, but a maximum of 40 percent of the remaining amount can be withdrawn after one year from the date of deposit. The facility of partial withdrawal is available only once before maturity.

You get this much lakh on maturity

If you invest a maximum of two lakh rupees in this scheme, then you will get an interest of Rs 32044 at the rate of 7.50 percent interest. In this way, a total of Rs 2,32044 is given on maturity in two years.

Terms and Conditions of the Scheme

In case of death of the account holder, the nominee or family members can withdraw this deposit amount. In case of life-threatening diseases, the money can be withdrawn for medical help. If you withdraw the money, you can also close the account. Closing the account is allowed after 6 months of opening the account. In such a case, the account holder will be given money at an interest rate of less than 2 percent.